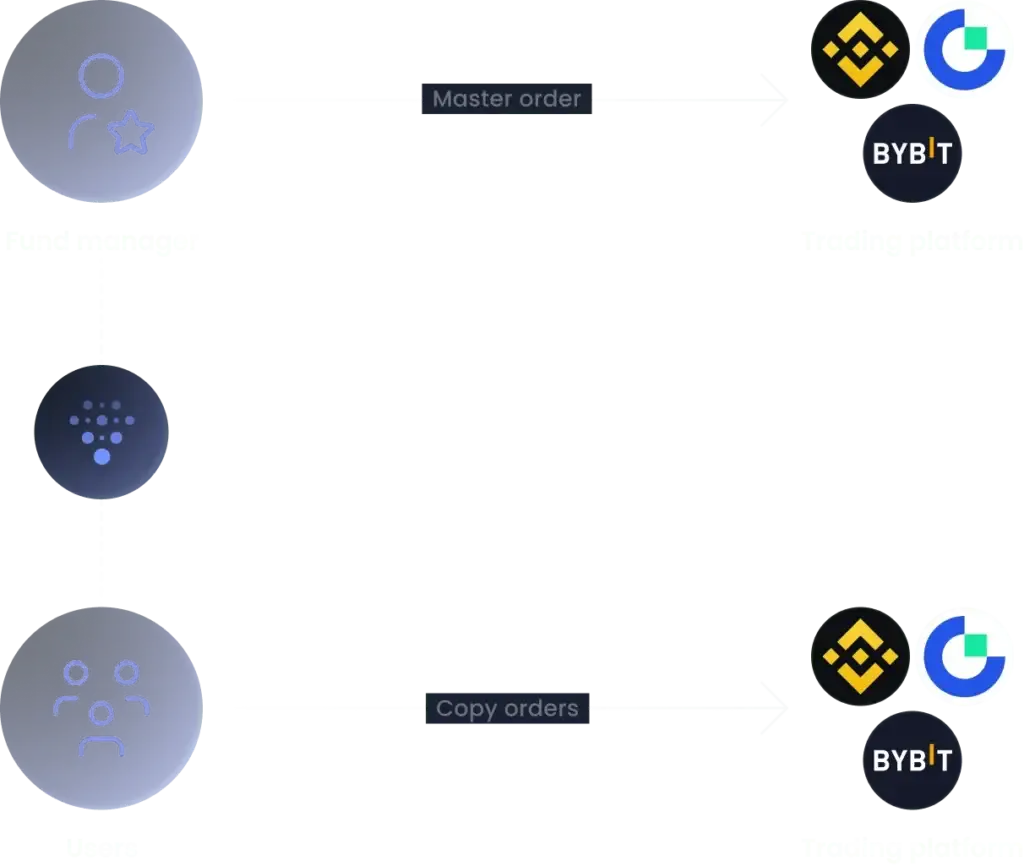

Non-Custodial Portfolio Replication allows members to take control of the managed investment relationship. Funds can typically charge much higher fees because all custody is held by the fund.

This allows a fund to ‘skim’ the investors pool of capital without impacting investors directly. Non-Custodial Portfolio Replication circumvents this and puts the power back into your hands.

A non-custodial investment is one that is transacted by an individual or entity on behalf of the investor.

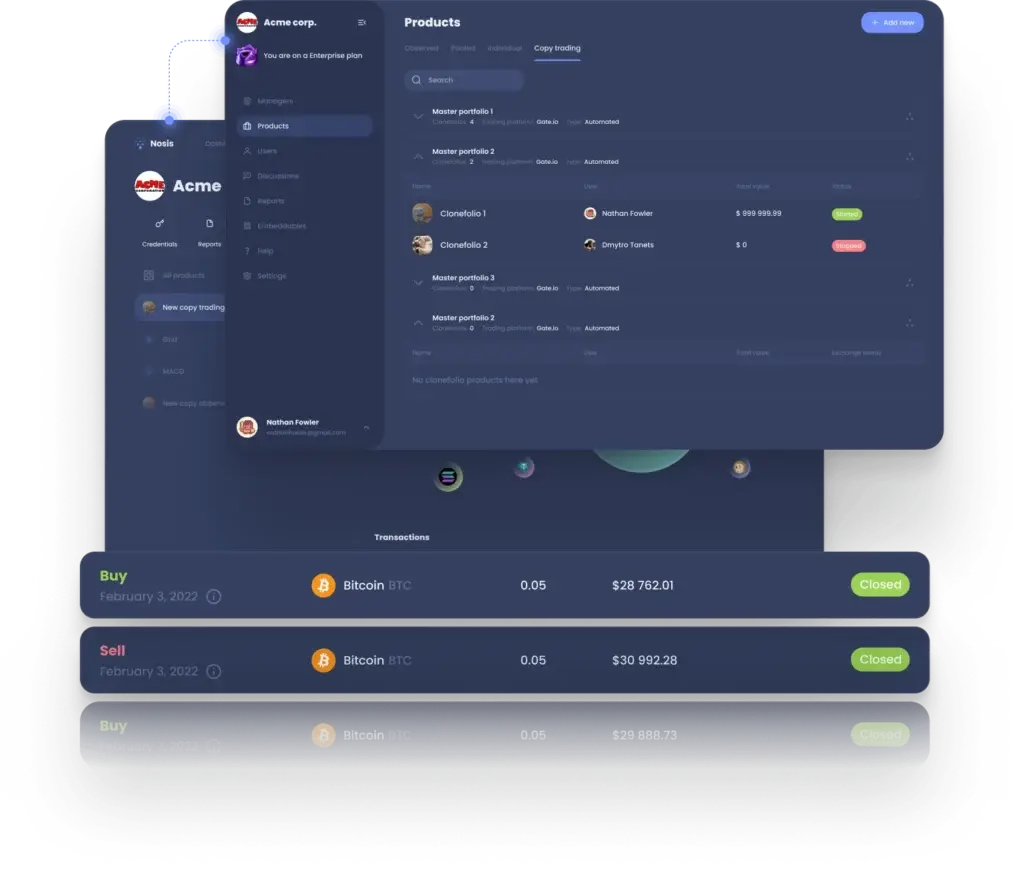

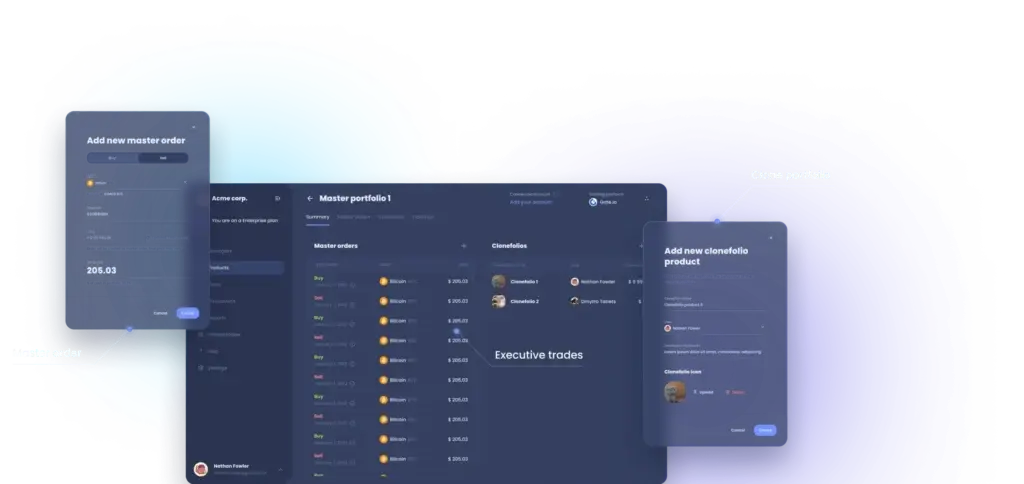

Non-custodial portfolio replication allows you to manage an entire portfolio and duplicate an investment strategy at scale.

Non-custodial portfolio replication is primarily aimed at those seeking to share investment strategies at scale.

Use it to effectively execute multiple trades for different members with only the click of a button.

Clear fees

No hidden costs, ever. Pay as you go for only what you need.

Super low cost

Offer traditional fund management services without all the hassle

Discretionary or non-discretionary

Final trade decisions can be assumed by the fund manager or handed over to the end user for strategies that require the member’s final decision/approval

Give your members a complete hedge fund experience with our all-in-one investment management tool.

Give your members a complete hedge fund experience with our all-in-one investment management tool.

© 2024 Nosis. All rights reserved

Sign up and get 30 days of Nosis Fund for FREE.