At its simplest, an algorithmic trading bot is a piece of computer code capable of generating and executing buy and sell orders in financial markets. The primary components of this kind of bot are entry rules that indicate when to buy or sell, exit rules that indicate when to close the current position and position size rules that define the amounts to purchase or sell, these rules comprise the bot’s “Logic”.

These bots are used to automate trading strategies that operate in timeframes too small for humans to execute. Nosis trading bot is a comprehensive bot capable of executing user-defined strategies.

How do Crypto Trading Bots Work?

Nosis’ trading bots do more than trade cryptocurrency; since they are powered by artificial intelligence, machine learning, and other smart technologies, they can gather real-time crypto market data through APIs. They then evaluate this data using predetermined trading techniques “Logic” to provide valuable and actionable metrics or conclusions referred to as trading signals.

The analysis is conducted to forecast future crypto values, such as those for Bitcoin and other currencies. The accuracy or precision with which the prediction is made counts. The closer the price is to the forecast, the more profitable the bot and crypto bot trading are since earnings are amplified.

After forecasting the future price, they put trading buy and sell orders in live cryptocurrency exchanges. Additionally, since most markets automatically execute limit and other kinds of orders, these buy and sell orders are executed.

The top cryptocurrency trading bots get information from various sources, including social media, news websites, and cryptocurrency market makers. This is why they use artificial intelligence and machine learning to discern whether the news has a social effect and is likely to impact market pricing significantly. Bots may be purchased independently as standalone software or incorporated into cryptocurrency exchanges.

Nosis Trading Bot Explained…

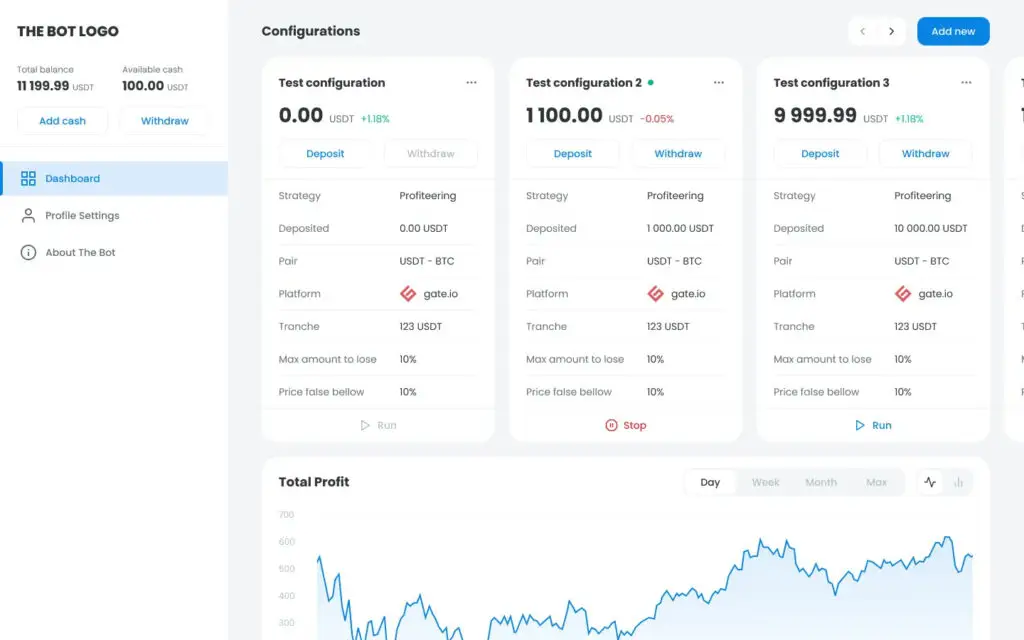

The first iteration of the Nosis trading bot is now live, and in which it can trade cryptocurrencies according to the strategies initiated by the user.

The Nosis trading bot will be released to the public in three iterations, and each iteration will come with new features and functionalities.

- 1st Iteration — Ability to trade Cryptocurrencies

- 2nd Iteration — Ability to trade Cryptocurrencies + FX

- 3rd Iteration — Ability to trade any financial instrument

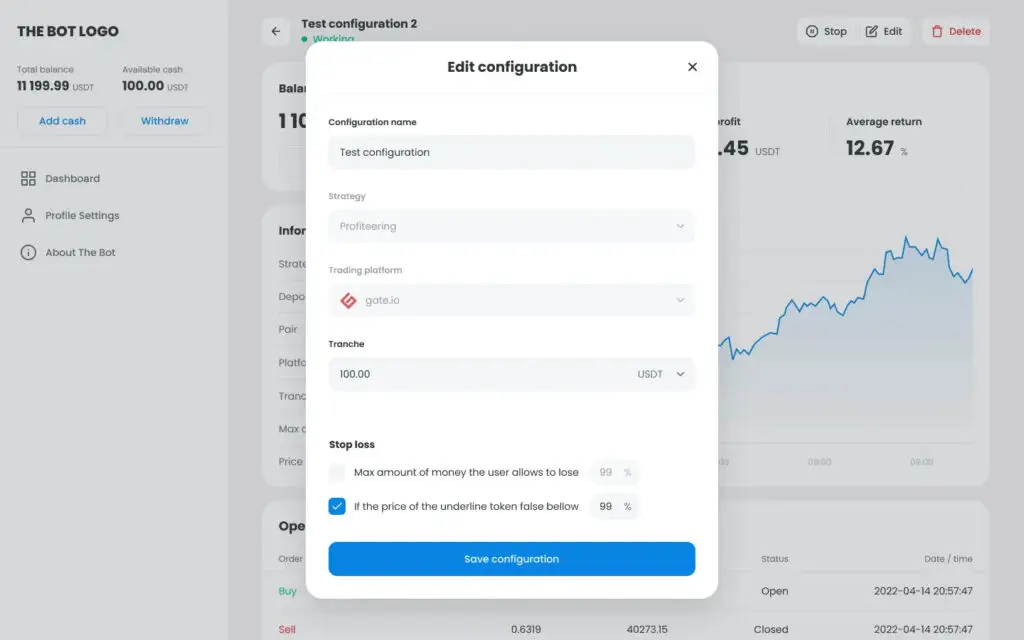

The Nosis trading bot comes with a list of inbuilt trading strategies that users will be able to use in their trading activities. These strategies include,

- Profit Bearing Strategy — This is an advanced trading strategy put together by experts in the Nosis team, and we do not intend to share more details about this strategy with the public.

- Front Running Strategy — This strategy allows users to make fast trades in just seconds. Suitable specifically for Market Order which requires trade to take place in intra seconds.

- Arbitrage Strategy — This trading strategy monitors behaviour across multiple exchanges and places buy orders in the exchange with the lowest price for that asset and sells it in another market at the same time to pocket the difference between the two prices.

The addition of the Nosis trading bot makes the Nosis platform to be more unique. More updates in this regard will be made in the upcoming days. Stay tuned!